Cardano (ADA) has faced a challenging period, experiencing a 42% correction since hitting a multi-year high of $1.32 in early December. The significant drop reflects broader market uncertainty, with increased selling pressure and cautious investor sentiment heavily weighing on ADA prices. Despite this, on-chain data suggests a change in dynamics that points to a possible recovery of the cryptocurrency involved.

Related reading

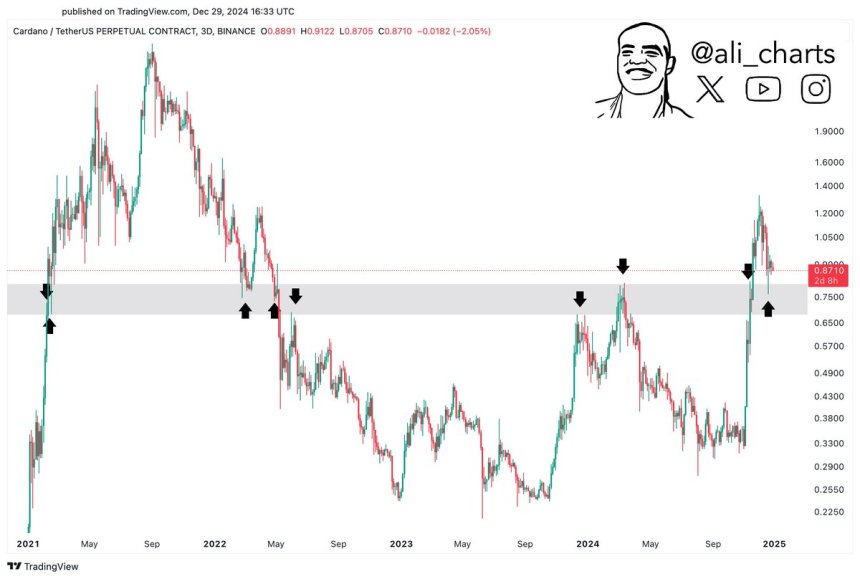

Senior analyst Ali Martinez highlighted key metrics that have shown whales rallying in recent weeks, adding a layer of optimism to the ADA outlook. According to Martinez, Cardano's most important support zone is between $0.77 and $0.68, a range that has been consistently observed by the market. This support has proven to be critical in stabilizing the ADA price and provides a base from which recovery can materialize.

Signals sustained interest from large holders Confidence in ADA's long-term potentialeven among short-term fluctuations. As Cardano continues to defend critical support levels, market participants are closely watching for signs of a breakout. As whale activity increases and technical indicators align, Cardano's next moves could redefine the whales' trajectory and offer a glimmer of hope in a challenging environment.

Cardano sets the stage for a move

Following its explosive rally in November, Cardano suffered a sharp decline and entered a deep correction that shook investor confidence. Despite the recent pullback, ADA appears to be stabilizing as it stabilizes above critical support levels, sparking renewed optimism for a possible rebound.

Ali Martinez, a prominent analyst recently Share technical analysis on Xidentifies Cardano's most important support zone between $0.77 and $0.68. According to Martinez, ADA's price action has closely respected this range, reinforcing its importance in preventing further declines. If the ADA holds above this level for a few more days, it could set the stage for a strong recovery and potentially reverse the downtrend.

The behavior of large market participants adds to the positive outlook. Chain data shows significant whale activity during this consolidation phase, indicating that major investors are taking advantage of lower prices to accumulate ADA. This accumulation pattern often indicates increased confidence in the long-term potential of a project, even in the face of short-term price fluctuations.

Related reading

As ADA holds its position above the critical support zone, market participants are eagerly awaiting a breakout. If a sustained rally occurs, it could position Cardano for a strong rally, retracing recent losses and possibly testing new highs.

Price action: Key supply for testing

Cardano is currently trading at $0.87, struggling with increasing selling pressure that has kept the price low. Despite the challenges, ADA has shown resilience by holding above key support levels, indicating that buyers are still active in the market. However, the next few days will be decisive in determining its direction.

A significant price milestone is at the $1 mark, which has served as a psychological resistance level in recent weeks. If ADA can successfully recapture $1 with strong volume and momentum, it could pave the way for a massive rally. Such a break would likely send ADA to a year-to-date high of $1.32, a level it last touched during its impressive November rally. Clearing this resistance indicates renewed bullish sentiment and potentially attracts more buying interest.

Related reading

On the downside, the risk of a deeper pullback remains if selling pressure intensifies. ADA could test lower demand areas around $0.75, which is consistent with historical support levels. This scenario is likely to lead to a further period of consolidation as the market seeks equilibrium. Currently, ADA remains at a crossroads, with both opportunities for improvement and further downside risks in play.

Featured image from Dall-E, chart from TradingView