Some analysts have raised concerns that Bitcoin may experience a potential crash triggered by the Chicago Mercantile Exchange (CME) split, which could lead to a sharp drop in its price.

As Bitcoin needs to fill this gap, crypto traders are predicting that it may push the first digital currency closer to the CME's critical gap, which suggests that the price could fall as low as $77,000 per coin.

Related reading

Bitcoin could fall to $77,000

Crypto analyst AgregCrypto suggested that the massive correction that Bitcoin has experienced could cause the coin to fall to the $77,000 mark.

Since October 2022, the flagship digital currency has been exposed to about seven significant drops, Igreg added, adding, “The average drop in these events is approximately 23.53%.

#BTC Abandonment – Average dump and CME (70K-74K): How and why?

1. Average drop:

From October 2022, #BTC It has experienced nearly seven significant drops. Here is the percentage reduction:1) 22.70%

2) 20.18%

3) 21.70%

4) 21.42%

5) 23.27%

6) 25.82%

7) 29.65%📊 Average drop in… pic.twitter.com/Vz6QiZlnzF

– EGRAG CRYPTO (@egragcrypto) December 27, 2024

From the current high of around 108,975, we are looking for a possible decline to the lower end of the CME GAP (between 77K-80K). This represents a 25% decline, which is well in line with the average decline seen this cycle, Igreg said in a post.

Egrag also noted that the 21 Weekly EMA is currently around $80,000, indicating that “another flash crash may be on the horizon.”

CME gap at $80,000

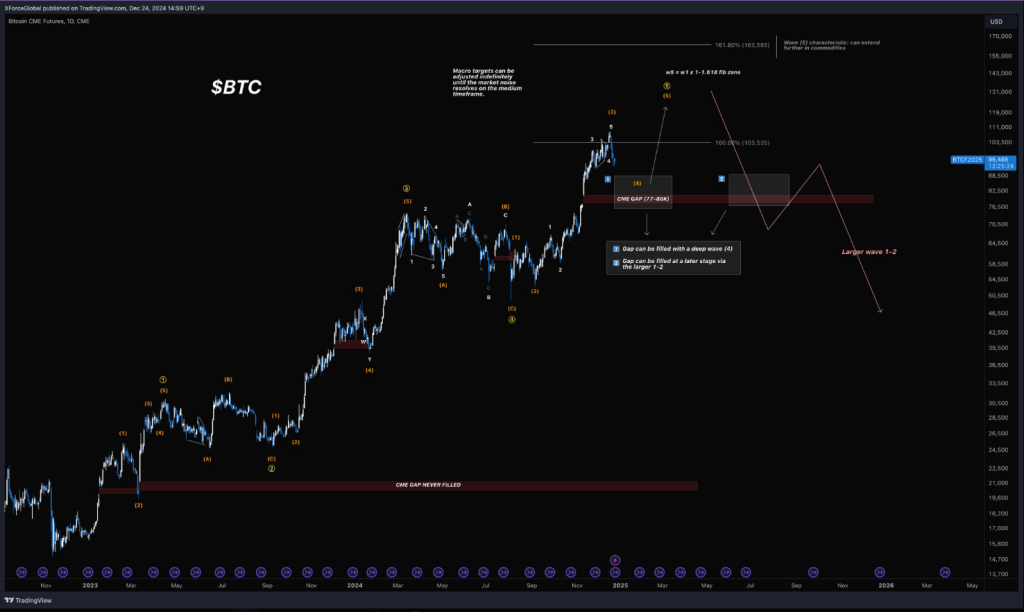

Another cryptocurrency analyst, XForceGlobal, reminded traders that “there is a 1D CME gap at $80,000.”

XForceGlobal said that historically, 90% of daily CME gaps have been larger than they eventually filled since 2018.

Just a friendly reminder: there is a 1D CME gap at $80,000.

Statistically, since 2018, as interest in gaps has increased, 90% of 1-day time-frame gaps larger than $1,000 have ended up being filled (ignore anything smaller than the 1-day time frame).

The tricky part with CME slots is that… pic.twitter.com/wJC2ih5U8M

— XForceGlobal (@XForceGlobal) December 24, 2024

However, the crypto analyst noted that it is difficult to predict when and how CME gaps will be filled.

“Part of the problem with CME gaps is that the timing and method of filling them remains unpredictable,” XForceGlobal said in a post.

Cryptocurrency analyst sees possible scenarios to fill CME gaps. In one scenario, XForceGlobal suggests that it could register a deep wave or wave 4 correction, sending Bitcoin down to the $77,000-$80,000 level.

In another scenario, XForceGlobal said it could be filled “later on through a hypothetical 1-2 correction after we finally finish the upside,” a scenario that could see BTC fall to $46,000.

Related reading

Market decline in January?

Eggerg believes market makers may use the upcoming inauguration of President-elect Donald Trump to fuel Bitcoin's selling pressure and contribute to its impending crash.

“Market makers are known for taking advantage of opportunities in times of crisis. On opening day (January 20, 2025) expect the market to empty. This could be the best local spot to sell, the crypto analyst says, and is likely to make many newcomers panic.

Aggreg outlined two scenarios that could emerge from current market conditions, suggesting that in one scenario, Bitcoin could reach $120,000 and later decline to the CME GAP before “resuming the uptrend in 2025.” to experience

In another possible scenario, the cryptocurrency analyst said Bitcoin could drop to the CME gap level between $70,000 and $75,000 before resuming the uptrend.

Featured image from Pexels, chart from TradingView