Bitcoin is navigating choppy waters as its price continues to decline, looking for a stable support level amid growing uncertainty. The current bearish move has raised concerns among investors and analysts, with many questioning whether Bitcoin has reached the peak of its cycle. Sentiment in the market has changed dramatically, with fear replacing the euphoric optimism that once drove the cryptocurrency to recent highs.

Related reading

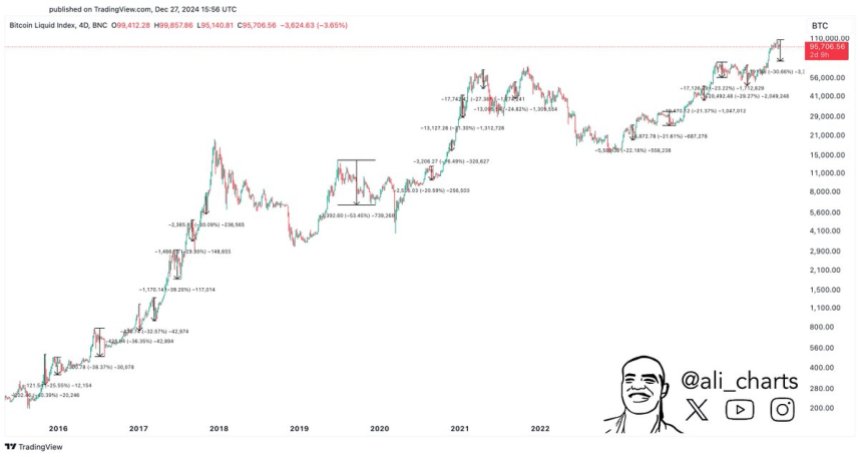

Despite the frustration, cryptocurrency analyst Ali Martinez offers a more optimistic view of the situation. In a recent analysis shared on X, Martinez suggested that a 20-30% correction could actually be the most bullish outcome for Bitcoin at this point. He shows how such pullbacks have historically paved the way for stronger rallies by shaking off weaker hands and allowing the market to recover before resuming its uptrend.

As the price of Bitcoin increases The edge of a potential failureall look at key support levels that can determine the next move. Will Bitcoin confirm fears of a cyclical uptrend, or will a healthy correction lay the foundation for the next phase of its ascent? The coming weeks will be crucial in shaping the narrative of the world's leading digital currency.

Bitcoin correction appears

Bitcoin appears to be on the verge of entering a critical correction phase, with the $92,000 level appearing as a line in the sand. Analysts and investors are increasingly concerned that a drop below that threshold — and possibly $90,000 — could trigger a wave of selling pressure and push the price below $80,000. Growing fear has cast a shadow over Bitcoin's bullish narrative as many brace for possible downside risks.

Related reading

However, not everyone sees this potential correction as bearish. Martinez offers an opposing viewsuggests that a 20-30% correction could be the most bullish outcome for Bitcoin within an uptrend.

Martinez presented a compelling chart showing every Bitcoin correction of more than 20% in past bull markets. His findings suggest that each correction acts as a reset for the market, shaking out weaker hands and paving the way for stronger gains.

Martinez emphasizes that corrections are a normal and healthy part of Bitcoin price cycles, especially during bullish periods. They set the stage for a sustained upward move by allowing the market to reset. If Bitcoin experiences a significant pullback, it could be in for a stronger and longer rally in the coming months.

BTC test “last line of defense”

Bitcoin is currently trading at $94,500, struggling with sustained selling and bearish pressure. Market sentiment has shifted significantly in recent days as concerns of a deeper shift have taken hold among analysts and investors. Many believe that if Bitcoin breaks the $92,000 mark, it could open the door for an accelerated decline.

The $90,000 level is emerging as a critical support zone that Bitcoin needs to hold to maintain its bullish outlook. This level represents a psychological and technical barrier that could determine the direction of the digital currency in the coming weeks. If Bitcoin can hold above $90,000, analysts predict a strong recovery that could rekindle the upward momentum and lead to a move to previous highs.

Related reading

However, the stakes are high. A decisive break below the $90,000 level is likely to intensify selling pressure and push Bitcoin deeper into correction territory. In such a scenario, prices could fall as low as $75,000, representing a significant pullback from recent highs.

Featured image from Dall-E, chart from TradingView