The recent rejection of $100,000 has sparked a wave of warnings from prominent financial analysts who are warning that Bitcoin may be poised for a significant pullback towards the $70,000 region, or even $60,000 in some cases. Ali Martinez (@ali_charts), cryptocurrency analyst, has been compiled The views of several market veterans on X provide a multi-faceted take on the likelihood of an impending correction.

Bitcoin price crash coming?

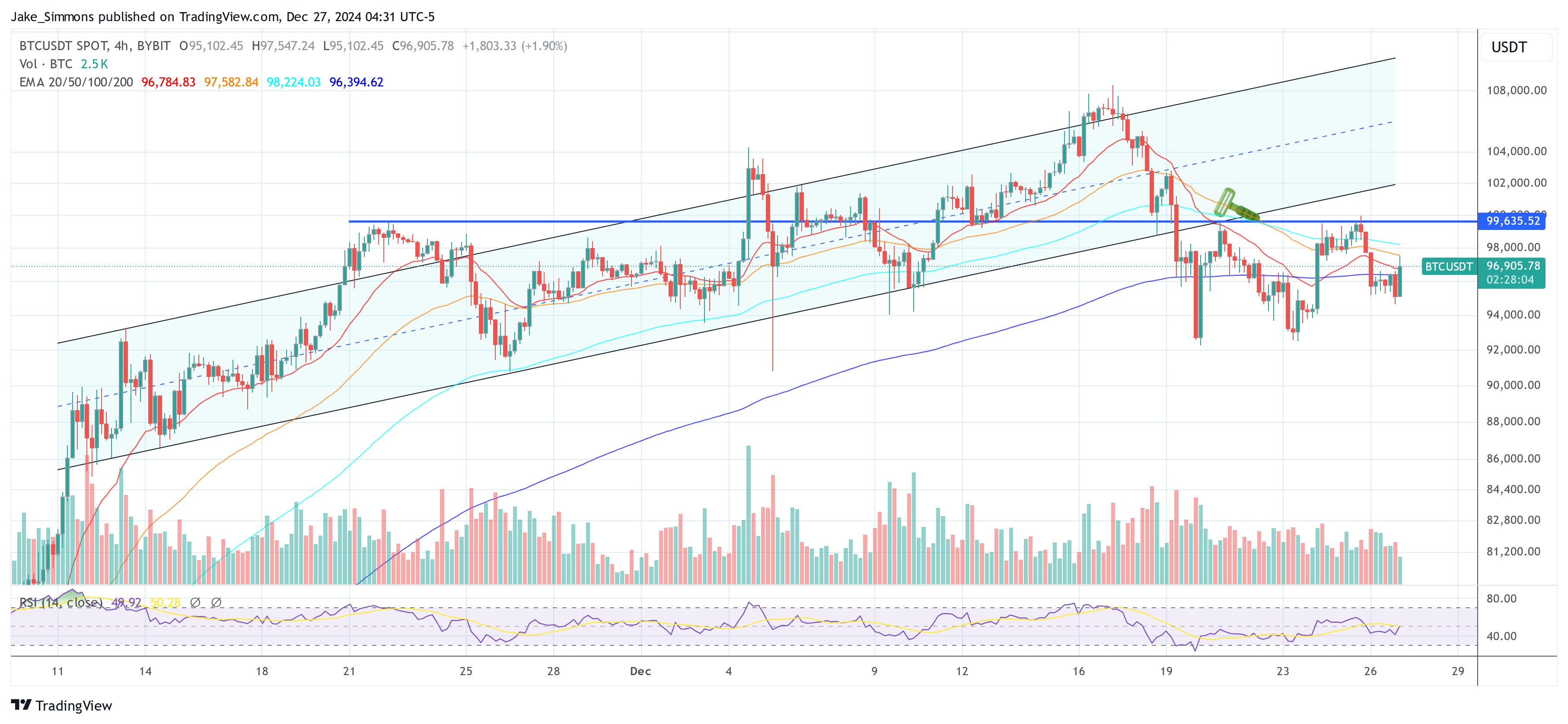

One voice in this debate is Tone Vays, a well-known trader who has expressed serious concerns about the direction of Bitcoin. Vays stated that Bitcoin trading below $95,000 is “very, very bad” as it raises the possibility of a correction to around $73,000.

In a shared video, Vays explained: “We are now opening monthly daily trades below $95,000, (…) getting too close to the $92,000 range is literally like Pandora's box in a A massive drop opens to $73,000. Now, I'm not saying that $73,000 will fall. I would say the possibility has increased significantly that we could easily reach $73,000. “You are sitting on the last line of support.”

Related reading

Another prominent analyst, Peter Brandt, added to the growing concern by discussing the formation of an expanding triangle on the Bitcoin price chart. According to Brandtthis pattern could potentially predict a correction towards the $70,000 area. Although Brandt was careful to clarify that his comments were not definitive predictions, he emphasized the possibility of such a move increasing.

“Hey trolls – this is not a prediction. Just always mention probabilities, not probabilities, not 'certainties.'” Brandt commented: “No screenshot needed, right-angled expanding triangle BTC could go back to $70,000” and has a test of parabolic modality.

Contrary to these bearish views, Fundstrat has a more optimistic long-term outlook, predicting that Bitcoin could reach $250,000 by 2025. However, Mark Newton, global head of technical strategy at Fundstrat, acknowledges the potential for short-term volatility and suggests that Bitcoin may experience a dip to $60,000 before starting to climb.

In a video shared by Fundstrat CEO Martinez Tom Lee “Bitcoin, one year from now, I think will be something like $250,000,” he explained of the outlook. (…) is very volatile. People don't like volatility. Yes, our technician Mark Newton thinks that the Bitcoin cycle will slow down a bit early next year, so maybe Bitcoin will reach $60,000.

Related reading

Benjamin Cowen, CEO and founder of Into The Cryptoverse, aside from caution, believes that Bitcoin's price action could mirror the price of the Nasdaq 100 (QQQ). According to Kaon, this alignment could lead to a sudden drop to $60,000, possibly at the same time as Donald Trumpopening day

From a chain analysis perspective, Martinez confirms the downside possibilities. He notes that if Bitcoin breaks below $93,806, the path to $70,085 becomes increasingly plausible, describing the area below as “open air to $70,085.” Martinez identifies a critical support zone between $97,041 and $93,806 and emphasizes that failure to sustain these levels could trigger a sharp decline.

He observes that market dynamics suggest that some investors are preparing for such a downturn, as evidenced by the transfer of more than 33,000 bitcoins (worth more than $3.23 billion) to exchanges in the past week. Additionally, profit-taking appears to be intensifying, with more than $7.17 billion worth of Bitcoin profits realized on December 23rd alone.

The proportion of Binance traders with open long positions in Bitcoin also fell from 66.73% to 53.60%, indicating a shift in market sentiment towards a more bearish stance.

Finally, Martinez emphasizes the importance of Bitcoin retrieving the $97,300 support zone to invalidate bearish forecasts. Bitcoin recently fell below one of its most important support areas at $97,300. Therefore, for the bearish outlook to be invalidated, BTC needs to recapture this critical area of support and more importantly, maintain a daily close above $100,000.

If Bitcoin can hold its daily close above $100,000, Martinez has the potential for a significant rally, possibly reaching $168,500 based on the Mayer Multiple. Failure to do so, however, leaves the door open for the anticipated reforms to materialize.

At press time, BTC was trading at $96,905.

Featured image created with DALL.E, chart from TradingView.com