Chainlink (LINK) has recently shown resilience after retreating 35% from its annual high, rallying more than 30% to test liquidity around $23. Despite this improvement, bearish sentiment continues to weigh on altcoins, and Chainlink is no exception. The cryptocurrency has struggled to make local highs, raising questions about whether the recent rally has enough momentum to sustain further gains.

Related reading

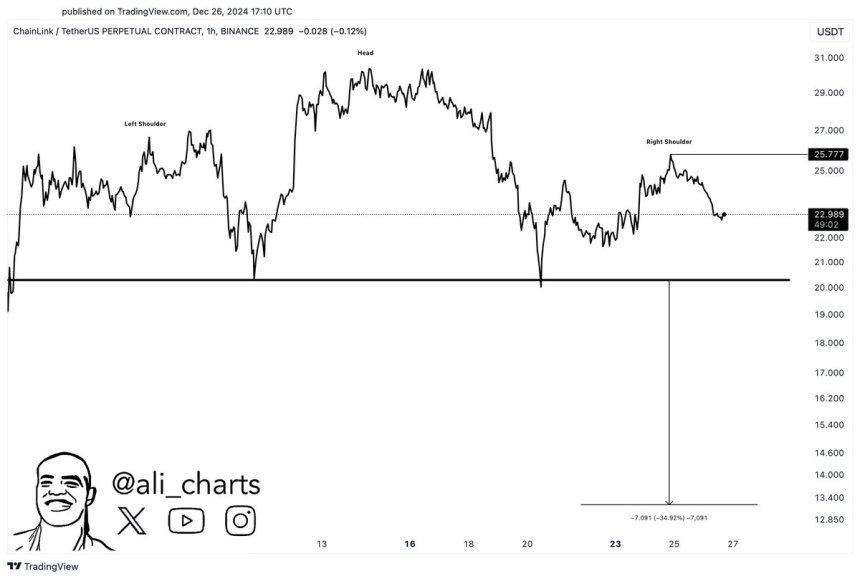

Top analyst Ali Martinez provided detailed technical analysis on X and highlighted an important pattern that could dictate LINK's next move. According to Martinez, Chainlink is forming a head and shoulders pattern – a structure that is often accompanied by bearish reversals. If this pattern is confirmed, LINK could face a significant decline, potentially going as low as $14 in the coming weeks.

This technical setup puts Chainlink at a crucial point where holding above current levels is critical to avoid a deeper correction. Investors and traders will closely monitor price action, with $23 as a key resistance level. Can LINK Overcome negative emotions Whether or not it succumbs to further declines is likely to depend on broader market conditions and its ability to reverse the bearish pattern. Currently, Chainlink's outlook is uncertain, keeping market participants on edge.

Chain link price action indicates weakness

Chainlink (LINK) has faced a challenging price environment since its breakout from its yearly high, reflecting a broader bearish sentiment in the altcoin market. Despite showing some recovery, LINK's price action has been limited and significant resistance has formed around $26. Retrieving this level is necessary to nullify the bearish prospects and revive the upward momentum.

Ali Martinez, the top analyst recently Share technical analysis on Xhighlights the potential formation of a head and shoulders pattern. This bearish adjustment, if confirmed, could send LINK down to $14. Such a move would represent a significant downside from current levels and underscore the challenges LINK faces in recovering from its previous highs.

However, all hope is not lost. Martinez notes that holding above $22 could provide Chainlink with a strong foothold to consolidate and potentially reverse the downtrend. A firm move above $27 would further strengthen the upside and signal a possible return to a more optimistic outlook.

Related reading

Currently, the market is still full of uncertainty. Broader market conditions, including Bitcoin's performance, are likely to influence LINK's trajectory. If LINK can successfully move through these key levels, it may overcome the bearish narrative and position itself for a more sustained rally. Until then, caution remains for traders and investors alike.

LINK liquidity test

Chainlink (LINK) is currently trading at $23 after successfully testing demand at the $22 level. Despite maintaining this vital support, price action lacks a definitive direction, leaving traders and investors in a state of uncertainty. Bears seem to be in control for now, with recent declines from annual highs weighing heavily on sentiment. However, the $22 mark has proven to be a resilient support, indicating that demand could rise at any moment to reverse the uptrend.

LINK needs to overcome the critical resistance of $26 to get out of this uncertain phase. A push above this level would invalidate the current bearish outlook and likely initiate a massive rally with the potential to revisit and surpass previous highs. Such a move would restore traders' confidence and could attract new buyers to further fuel the move.

Related reading

On the downside, failure to hold above $22 exposes LINK to increased selling pressure, which could test lower support levels and prolong the downtrend. Right now, the market is still at a tipping point, with both bulls and bears waiting for the next decisive move. The coming days will be critical for LINK as it looks to find direction amid broader market uncertainty.

Featured image from Dall-E, chart from TradingView