XRP has been range-bound in recent days, consolidating after successfully holding above the critical $2.10 support level. As one of the standout performers in this cycle, XRP saw a significant rally after the US election and caught the attention of investors. However, recent price action has created uncertainty and has some investors worried about the possibility of further declines.

Related reading

Despite these fears, chain data tells a different story. Santiment Insights shows that whales have collected another 40 million XRP in the last 24 hours. This significant accumulation suggests that Smart Money may be positioning itself for an upcoming rally. Historically, such whale activity has preceded major price moves and provides a bullish signal for long-term holders.

XRP's ability to hold the $2.10 support level It shows resilience amid market volatility, but the next decisive move will depend on whether the bulls can capitalize on this build-up phase. If the buying momentum continues and XRP breaks out of its current range, a move to new highs may follow.

XRP continues to signal strength

XRP continues to show resilience, trading above key support levels, attracting investors who recognize its long-term potential. Despite a significant 30% decline from recent highs, XRP has held its ground and maintained critical support zones that reinforce the bullish outlook. This stability instills confidence among market participants, and many see the altcoin as a major contender for future growth.

Ali Martinez, the top analyst recently Highlighted compelling data from Santimentshowing that whales added another 40 million XRP to their reserves in the last 24 hours. This follows a broader trend of continued whale accumulation, a phenomenon often seen as an indicator of smart money positioning for a major market move. Such activity suggests that institutional and high net worth investors expect XRP to outperform in the coming months.

Sustained interest in XRP stems from its ability to remain strong despite recent corrections and broader market uncertainty. Holding above key support levels not only indicates technical strength, but also underscores investor confidence in its potential for significant upside.

Related reading

As whales continue to accumulate and sentiment shifts, XRP is well positioned to capitalize on the positive momentum. A break above resistance levels could be the start of a strong rally and strengthen its leadership among altcoins in the current cycle.

Technical Analysis: Key Levels to Watch

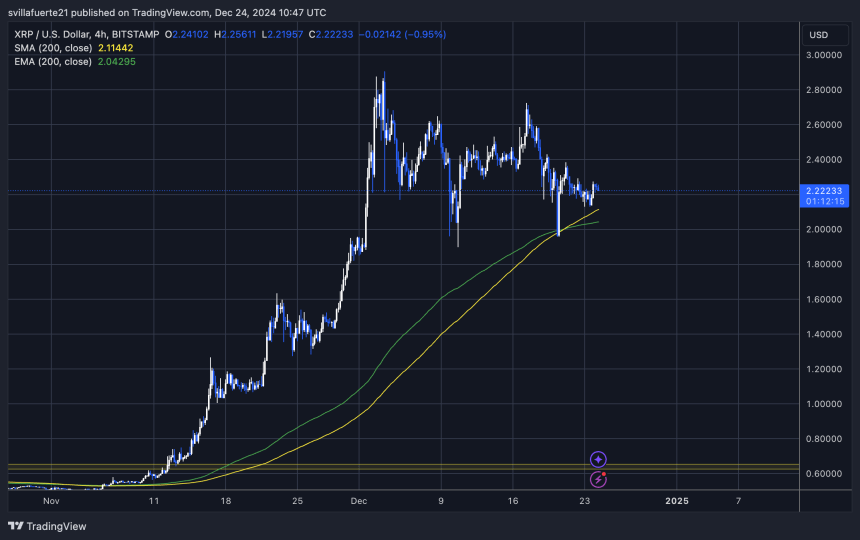

XRP is currently trading at $2.22 after successfully testing the 4-hour moving average (MA) and exponential moving average (EMA) around $1.96 a few days ago. This breakout of critical support levels highlights XRP's near-term strength and reinforces its upward momentum. The MA and EMA are widely regarded as key indicators for assessing the health of an asset, and XRP's ability to hold above them indicates strong demand at lower levels.

Holding the support above $2.13 in the coming days is essential to maintain the momentum. If XRP continues to trade above this level, it will boost investor confidence and pave the way for a potential test of the $2.40 resistance. A break above $2.40 is likely to bring more buying interest, potentially pushing XRP to new highs as broader market sentiment improves.

Related reading

On the other hand, a loss of the $2.13 support could create short-term weakness, leading to a retest of lower levels near the MA and EMA. However, as long as XRP maintains its overall structure above these moving averages, the bullish narrative remains intact and the altcoin can continue to attract smart money positioning for the next rally.

Featured image from Dall-E, chart from TradingView