A quant has explained how the latest trend in the Coinbase Bitcoin Premium Index could mean a buying opportunity for the asset.

The Coinbase Bitcoin Premium Index has fallen to -0.221%.

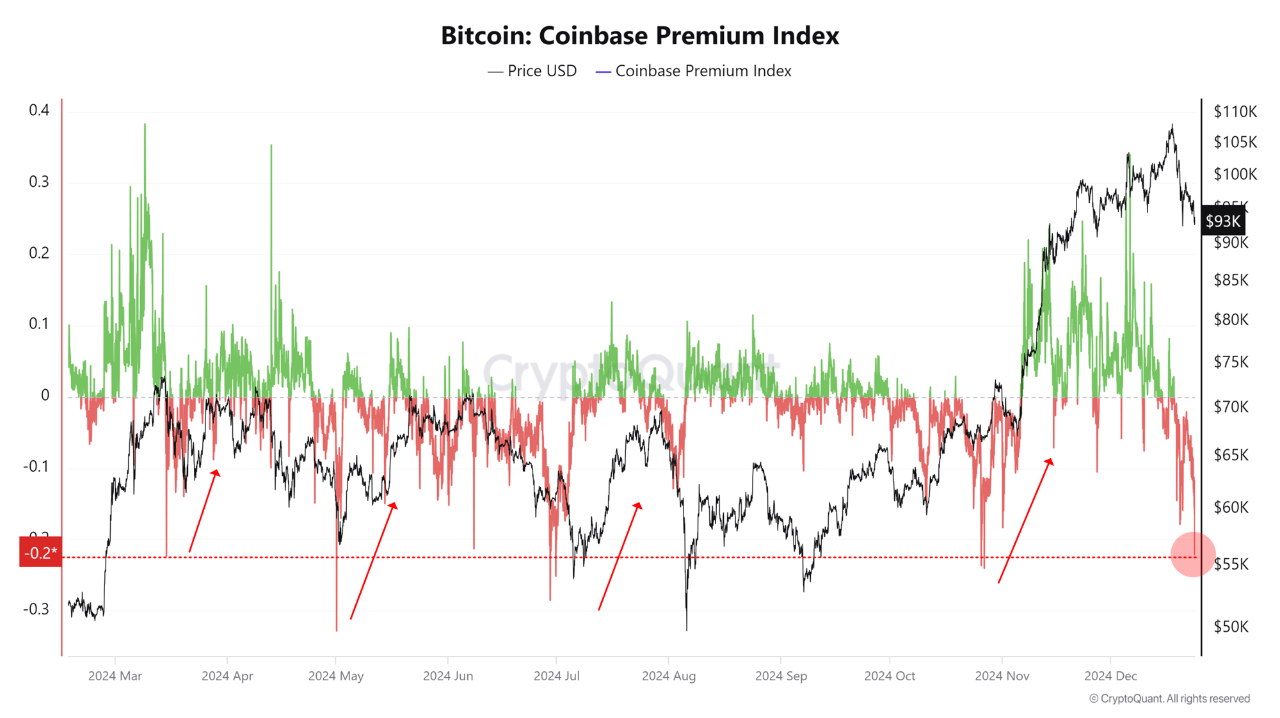

In a CryptoQuant Quicktake postAn analyst discussed the latest developments in the Coinbase Bitcoin Premium Index. “Coinbase Premium Index” refers to a measure that tracks the percentage difference in the price of Bitcoin on Coinbase (USD pair) and Binance (USDT pair).

When the value of this metric is positive, it means that the digital currency is traded at a higher rate on Coinbase than on Binance. Such a trend indicates that there is higher buying pressure or lower selling pressure compared to the latter.

On the other hand, this indicator being below zero indicates that Binance users are participating in more purchases than Coinbase users, as they have pushed Bitcoin to a higher value there.

Now there's a chart showing the trend of the Coinbase Bitcoin Premium Index over the past few months:

From the chart, it can be seen that the Coinbase Bitcoin Premium Index recently made a sharp decline in negative territory, which means that sellers have appeared on Coinbase.

Along with this sale, the price of BTC also witnessed a is reducedwhich suggests that negative premiums can be its source. The cryptocurrency has actually followed this indicator throughout the year and its price goes up and down along with the buying and selling changes on Coinbase.

The reason for this relationship potentially lies in the fact that Coinbase is based in the United States Institutional investorswhich have had a significant presence in the market this year.

Coinbase's Premium Index being in the red right now naturally means selling these giant investors. Given that the price of Bitcoin follows the benchmark, this would be a bearish signal for the asset.

However, there is another pattern that could have a different outcome for Bitcoin. As the quant shows in the chart, this metric has rebounded whenever its value reached -0.2% in the past year.

An explanation for this pattern may be that it is usually around this sell-off level that new buyers appear and decide to pile in on the decline, in the process driving up benchmarks as well as price.

The current value of this indicator is at -0.221%, so Bitcoin may be close to its lowest level, if it has not already reached its lowest level. Of course, this will only happen if institutional investors think that the uptrend will continue.

Bitcoin price

Bitcoin briefly dipped below the $93,000 level yesterday, but the coin appears to have made a comeback as it is now trading around $94,100.