Bitcoin price extended losses and traded below the $100,000 zone. Bitcoin is showing bearish signs and may move towards the $91,200 support area.

- Bitcoin started a new decline from the $100,000 resistance zone.

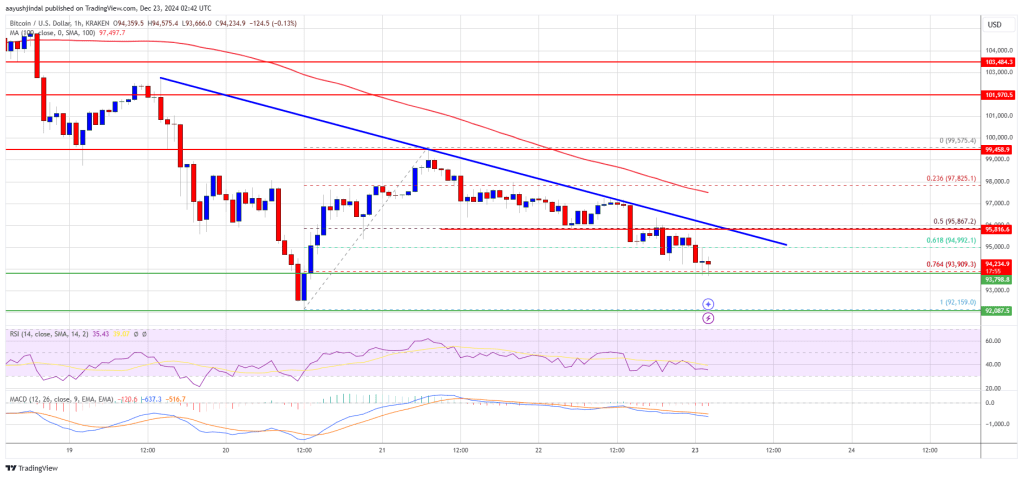

- The price is trading below $98,000 and the 100 hourly simple moving average.

- A key bearish trend line is forming with resistance at $95,850 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- If it stays above the $92,000 support zone, the pair could start a new rally.

Bitcoin price dropped again

Bitcoin price failed to start another rally and Long losses Below the $100,000 area, Bitcoin gained downward momentum below the $98,000 and $96,500 levels.

The price even reached below $92,250. A low was formed at $92,159 before the rally started. However, the bears were active near the $100,000 level. A peak was formed at $99,575 and the price started another decline. It traded below the $96,500 level.

There was a clear move below the 50% retracement Fib retracement level from the swing high of $92,159 to the high of $99,575. A key bearish trend line is also forming with resistance at $95,850 on the hourly chart of the BTC/USD pair.

Bitcoin price is now trading below $98,000 100 hourly simple moving average. It is also testing the 76.4% retracement Fib level from the swing low of $92,159 to the high of $99,575.

In the uptrend, immediate resistance is near the $95,000 level. The first key resistance is near the $95,850 level. A clear move above the $95,850 resistance may push the price higher. The next key resistance could be $97,800. A close above the $97,800 resistance may push the price higher.

In the mentioned case, the price could rise and test the $98,500 resistance level. Any further gains may push the price to the $100,000 level.

More cons in BTC?

If Bitcoin fails to break above the $95,850 resistance area, it can continue to move. Immediate support on the downside is near the $93,800 level.

The first major support is near the $92,500 level. The next support is now near the $91,200 area. Any further losses may push the price towards the $90,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now rising in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Key support levels – $92,500, followed by $91,200.

Key resistance levels – $95,850 and $97,800.