The following is a guest post by Shane Neagle, editor of The Tokenist.

With the US presidential election now over, Bitcoin has almost reached a weekly high in November. Upon reaching the $100,000 threshold on November 22nd, Bitcoin It has reinvigorated the altcoin market and now has a 1.49 trillion dollars market value

Conventional wisdom suggests that altcoins will follow Bitcoin, as previous trends have shown. But what kind of altcoins should have significant performance? More importantly, are there any new principles at play that need to be considered this time around?

First, let's examine the relationship between Bitcoin and altcoins. It is more important than one might think.

Why is Bitcoin leading the cryptocurrency market?

From the launch of the Bitcoin mainnet in January 2009 until the price of Bitcoin reached the threshold of $10,000 in November 2017, it took nearly 9 years. Although Bitcoin gradually became a household name, it still maintained the status of a new and highly speculative asset. This is understandable in a central banking system, where money is synonymous with government decrees – fiat money (by decree).

Therefore, belief in government decrees and the use of force by the government is what gives value to money. This has been common wisdom for generations. In addition, there is the media debate. If Bitcoin is not a physical paper token issued by a central bank, but digital, how can it be trusted?

Blockchain enthusiasts already know the answer. The central bank, the Federal Reserve, also relies on an electronic ledger that can represent its accounting as physical tokens (paper money). But not necessarily. In contrast, the whole point of the Bitcoin ledger is that its accounting is fortified against arbitrary dilution.

That makes Bitcoin quasi-digital. Its accounting is applied with computing power through a proof-of-work algorithm, which creates a bridge between the digital and the physical. Physical resources are energy and hardware assets required for computing power. As a result, Bitcoin regulates the altcoin market:

- As the first cryptocurrency, the monetary aspect of Bitcoin is easy to understand.

- As is the Bitcoin network Computing power As it grows, holders have more confidence in the integrity of Bitcoin's accounting (distributed ledger).

- As new altcoins emerge, they are traded against Bitcoin, a market benchmark that depends on the physicality of energy and hardware.

- In times of uncertainty about the valuation of altcoins, Bitcoin holders return to Bitcoin as a safer asset.

- Likewise, when Bitcoin prices rise, holders of small-cap altcoins flood because the potential for profit is greater. However, it is more difficult to move the great weight that Bitcoin holds.

Conversely, Bitcoin's large market capitalization acts as a psychological cushion, always ready to attract fleeing altcoin capital in times of distress. But in a very stressful scenario, this capital may flee Bitcoin itself.

The problem is that if enough capital flows into the altcoin, the entire crypto market will collapse, as many see Bitcoin as just another cryptocurrency, even though it has a first-mover advantage.

The return of Altcoin-Bitcoin

The relationship between the Federal Reserve and the cryptocurrency market is intrinsic. When the central bank over its balance sheet 6 trillion dollarsBetween 2020 and 2022, inflated liquidity poured into crypto assets, prompting traders to explore popular trading strategies to maximize opportunities.

Previously, crypto liquidity increased during the initial coin offering (ICO) era, peaking between 2017 and 2018. Ethereum (ETH), Cardano (ADA), EOS (EOS), Tezos (XTZ), Stellar (XLM), Algorand (something), Neo, FileCoin (FIL), Tron (TRX), chain link (LINK)and many more.

However, all liquidity is limited. The expansion of the altcoin market destroyed the dominance of the Bitcoin market. Traders often to Chambers of Commerce During such pivotal changes to share strategies and insights in navigating market changes effectively.

Although the ICO boom spawned dozens of altcoins, it is Most of them were scammers Or Dead in the Water As a result, Bitcoin regained some lost ground until the Fed's unprecedented monetary intervention during the pandemic narrative.

After the Fed spree, Bitcoin's dominance further declined. The altcoin market lost around $60 billion after the over-leveraged Terra (LUNA) pegged to the algorithmic stablecoin TerraUSD crashed.

But since the top altcoins were already outperforming Bitcoin, the incentive to speculate remained because of the lower market cap and higher profit potential. This further reduced Bitcoin's dominance, but only temporarily.

In a classic domino-toppling scenario, by the end of 2022, the liquidity rug implemented by the Federal Reserve brought down the over-leveraged exchange FTX and shocked the entire cryptocurrency market. Bitcoin plunged into panic selling and fell to the pre-2020 $16,500 price level.

However, when the big question mark appeared on the whole cryptocurrency market, Bitcoin started to recover. US Regional Banking Crisis, Spring 2023 Helped the case For Bitcoin Fundamentals, approval of Bitcoin ETFs in early 2024 and the fourth halving set the stage for new recent record highs.

But how has the altcoin market evolved alongside Bitcoin?

Memecoin's dominance is telling

Most of the “old guard” altcoins focused on blockchain infrastructure, decentralized finance (DeFi), and other efforts to tokenize human activity through smart contracts. However, the 2022 crypto crash seems to have left psychological scars.

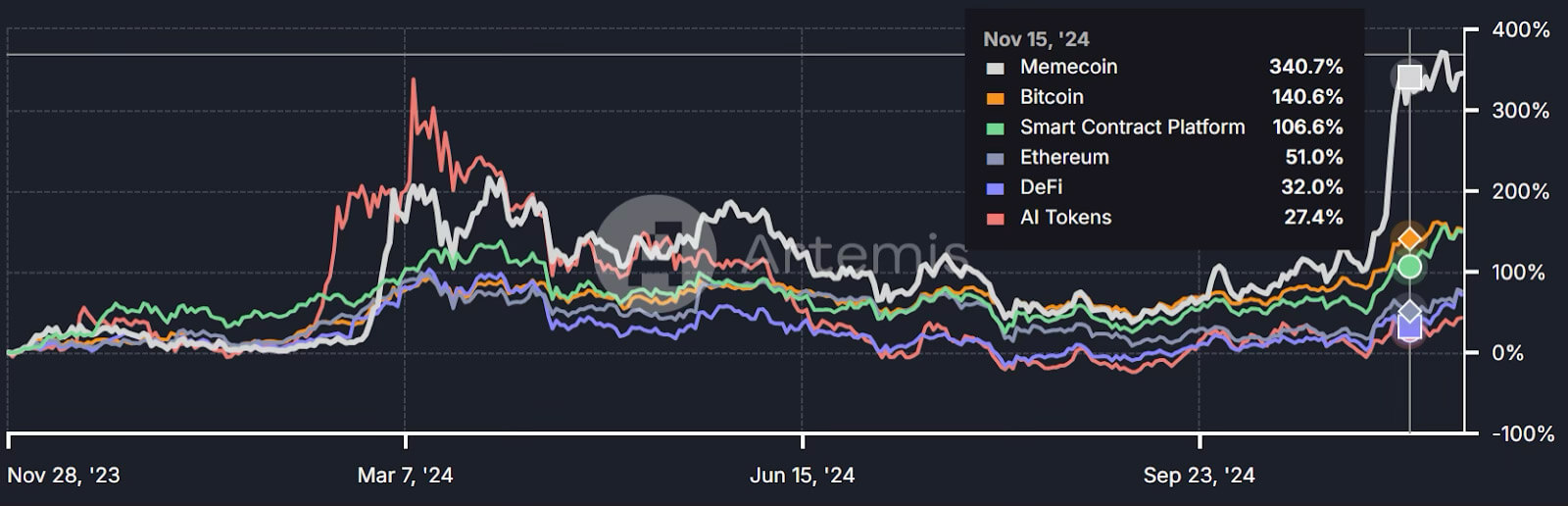

The lofty narratives of the previous cycle were largely replaced by hyped gambling via memecoins. Artemis data shows that Memcoins have dominated the cryptocurrency market, with only AI tokens outperforming them in early 2024.

By mid-November, memecoins returned 6x the value than the average crypto market

This coincides with Donald Trump For his second term in the Oval Office. In turn, this suggests that crypto holders are getting used to social media-driven hype cycles around communities rather than altcoin fundamentals.

Likewise, the AI revolution is still going strong. Apart from various software and providers “ChatGPT with makeup”. Offering hosted GPU serversArtificial intelligence cryptos are also a hot topic and the release of AI agents is expected to rule out another bull run.

Kaito AI, a market insight platform, found that one in four cryptocurrency investors prioritized the memecoin debate. In other words, the focus is on short-term profit rather than long-term return on value. It is suitable for more dynamic traders who follow cryptocurrency trends every day.

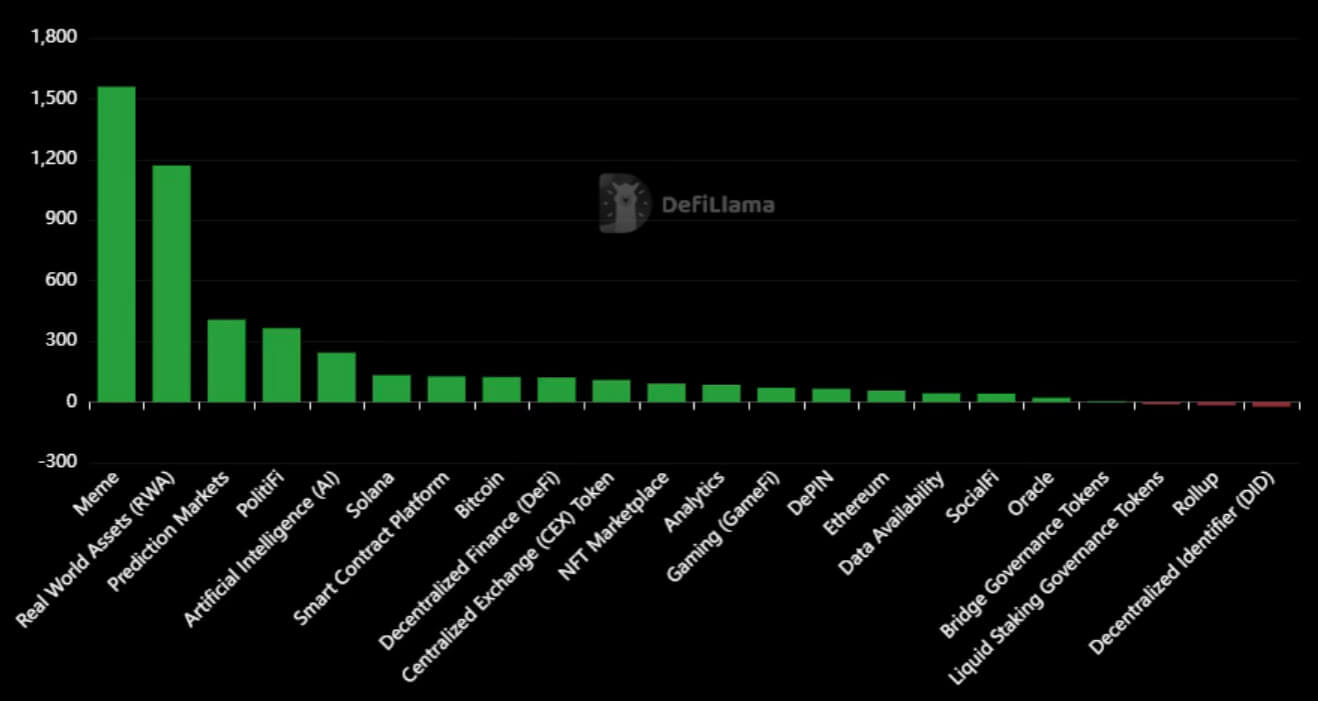

In terms of validity, the following altcoin categories outperformed Bitcoin year-to-date: Memes, Real World Assets (RWA), Prediction Markets, PolitiFi, AI, Solana, and Smart Contract Platforms.

There is a total 15713 Digital currencies in circulation are tracked in 1178 exchanges and 494 categories. Such a huge amount of digital assets, in many categories, creates a daunting mental burden to filter the wheat from the chaff.

On the contrary, the popularity of memecoins is one of the effects of managing that mental load. After all, their simplicity and virality is itself a filtering mechanism. But another side effect is a return to the “old guard” altcoins.

Older altcoins are returning to a friendlier scene

The fall in crypto prices in 2022 was so severe that it made no sense to sell altcoins at such prices. As a result, it is fair to say that many losses were unrealized in anticipation of a new price hike.

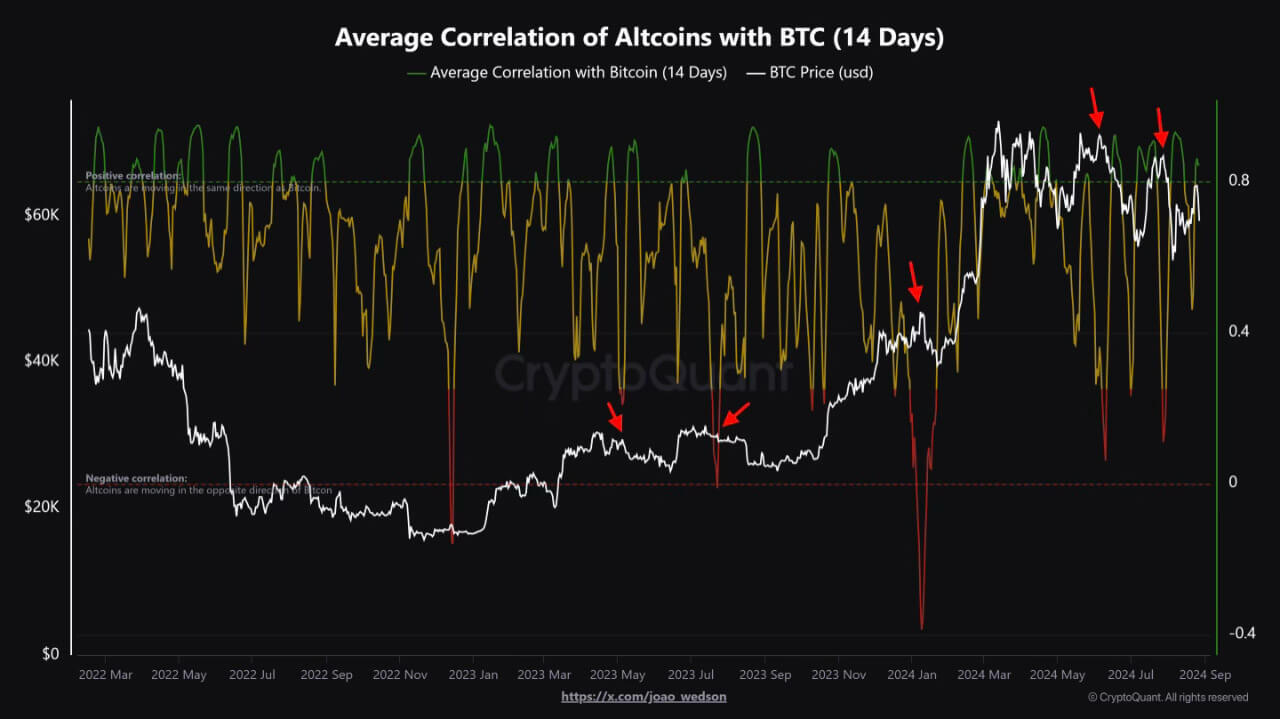

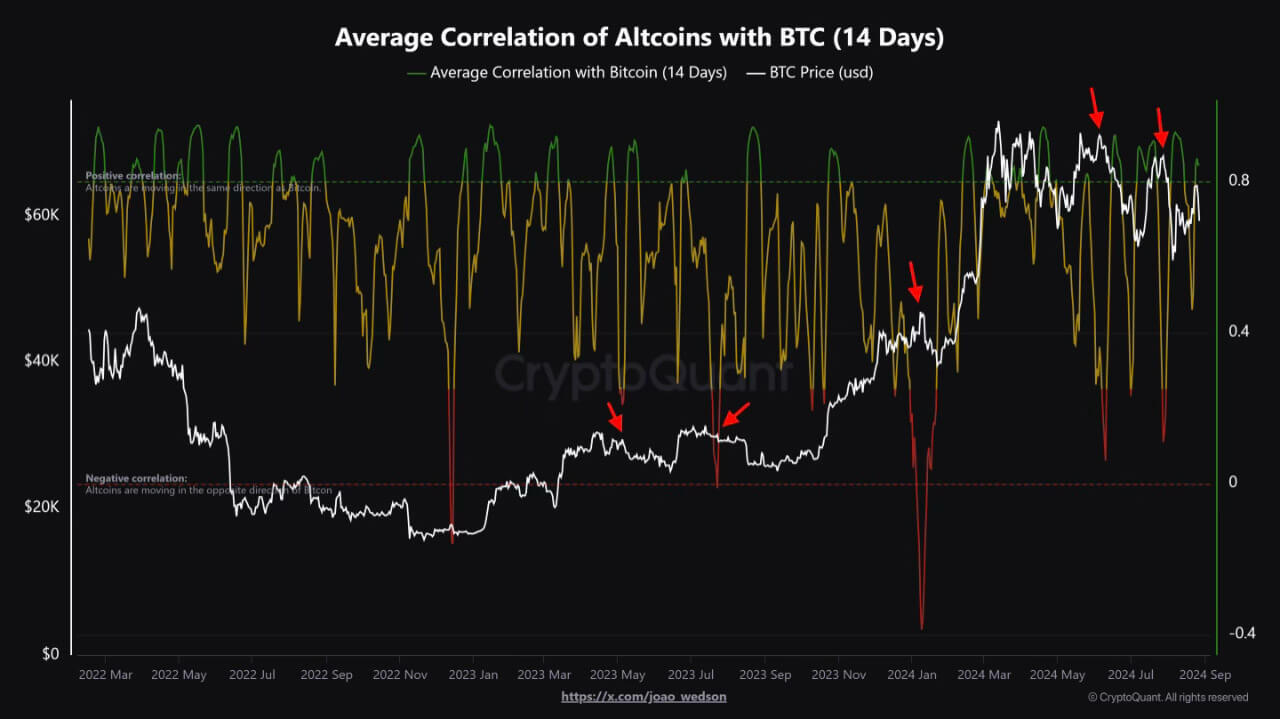

Bitcoin's latest uptrend seems to have started this cycle. At the end of August, CryptoQuant's Joao Wedson observed that the altcoin market was once again aligning with Bitcoin.

Among the top 20 altcoins (excluding stablecoins) from the previous cycle, 11 remain during the November 2021 uptrend peak. Although many of their prices are still a long way from their previous highs, they have the potential to recover ground assuming this is just the start of a new uptrend.

If more exchange-traded funds (ETFs) are approved, this could happen, pushing Bitcoin higher earlier in the year. desired item, NYSE Arca was recently registered For Bitwise 10 Crypto Index Fund, including the following coins:

| Asset portfolio | symbol | weight |

|---|---|---|

| Bitcoin | Bitcoin | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| XRP | XRP | 1.50% |

| Cardano | ADA | 0.70% |

| Avalanche | Avax | 0.60% |

| chain link | link | 0.40% |

| Bitcoin Cash | BCH | 0.40% |

| Polkadot | point | 0.30% |

| Unswap | Uni | 0.30% |

Interestingly, Bitcoin's weight in the index is much higher than Bitcoin's current dominance. Once again, this points to the problem of crypto dilution. Although altcoins are cheaper, there are so many of them that it is difficult to measure their fair value in the long term.

Likewise, their scarcity is not guaranteed. As more focused projects, their inflation rates can be subject to change. For example, the current inflation rate of Solana is SOL tokens 4.886% While the offer is long term 1.5%.

Nevertheless, now that the anti-crypto SEC chief is on the way, the crypto market is likely to deepen its liquidity pool, while the apparently crypto-friendly Trump administration is on the way. In addition, the recent ruling that The sanctions against Tornado Cash were illegal It is likely to have far-reaching consequences.

The court effectively confirmed that dApps are a new type of asset that lacks sanctionable ownership as smart contract code. In other words, the court restored the common sense that open source cannot be property.

bottom line

Even with the historically increased money supply, liquidity is limited. Bitcoin was able to become the most liquid cryptocurrency because it created a completely different way of looking at money. This has given rise to the monetary potential of countless altcoins and expanded the use of smart contracts.

But instead of expanding, the crypto market was constrained by widespread fraud and over-leverage, dragging Bitcoin down with it. In a cleaner market and a more bullish regulatory landscape, Bitcoin is now poised to outperform altcoins.

Among the daunting number of altcoins, first-generation altcoins have re-emerged and attempted to anchor their value to established familiarity.