Among A A general price drop in the crypto market Over the past week, Ethereum (ETH) recorded a price correction of over 19.5% and found support at the local low of $3,100. Since then, the prominent altcoin has shown little resistance in just the past two days, rising more than 5%. However, recent data on wallet activity raises many grounds for Ethereum's long-term future.

Ethereum HODL increases supply dominance by 16%

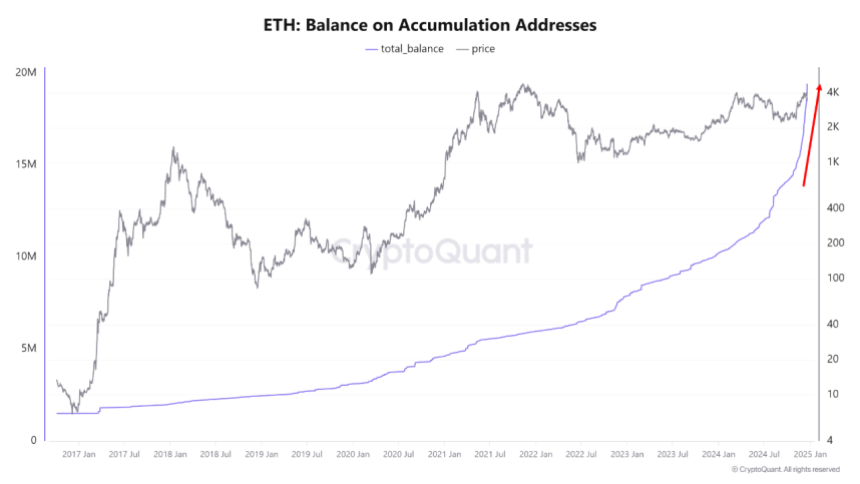

in the recent Post QuickTakeCryptoQuant analyst MAC_D shared a positive view on the Ethereum market.

The crypto market expert reports that the inventory of Ethereum staking addresses increased by a significant 60% from August to December. During this time, these HODL wallets have increased their share of the ETH supply from 10% to 16%, i.e. 19.4 million ETH out of 120 million ETH.

To explain, aggregator addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a measure of long-term investment and certainty.

According to MAC_D, the rapid increase in inventory of HODL Ethereum wallets is a new development that has not been present in previous bullish cycles. The analyst attributed this huge accumulation rate to the bullish expectations of investors from the incoming administration of Donald Trump in the United States.

These expectations include more favorable provisions on DiFi industry which represents a major part of the Ethereum ecosystem. Therefore, regardless of the current Ethereum price movement, these long-term wallets will likely continue to increase their holdings in anticipation of future price growth.

Furthermore, MAC_D emphasizes the importance of these stacked addresses, as the price of Ethereum has never fallen below their true value. Therefore, constant buying by these wallets provides a high potential for long-term price appreciation.

What's next for ETH?

Regarding Ethereum's immediate movement, MAC_D cautions that macroeconomic factors are likely to have a stronger impact on Ethereum's price in the short term, as shown by the recent price collapse due to the potential easing of the 2025 interest rate cut.

At the time of writing, the altcoin is trading at $3,352, following a 3.07% decline in the last 24 hours. At the same time, Ethereum's daily trading volume has decreased by 53.25% and is worth $31.15 billion.

After the recent price drop, Ethereum is also showing negative performance on the larger charts with losses of 14.74% and 1.05% over the past 7 and 30 days. On the plus side, the asset's price remains well above its initial price ($2,397) at the start of the post-US election rally, suggesting long-term sentiment is positive.

With a market cap of $401 billion, Ethereum continues to rank as the second largest cryptocurrency and largest altcoin in the digital asset market.