With just one day left in the new year, cryptocurrency analyst Alex Wacy (@wacy_time1) shared Overview The analyst, who has amassed more than 190,000 viewers on X, highlighted several projects that he believes have the potential to dominate the upcoming season.

The best altcoins in 2025

He begins with render (RNDR)it as a Decentralized GPU rendering platform For artificial intelligence, metaverse, and creative content. “Rendering is poised to become a key player in the virtual future,” he said, pointing to its $3.66 billion market cap as evidence of investor confidence.

Follow closely virtualAn AI-based avatar initiative with a market cap of $3.41 billion, Wacy announced Virtual as a “2024 growth leader in the virtual avatar segment” and predicts increased adoption for metaverse, gaming and social media applications.

Weissy also turns his attention SEKOIAmentioned his focus on identifying and guiding the emerging talents of artificial intelligence. Although on a smaller scale with a market cap of $94 million, this independent AI investment agent uses advanced pattern recognition and quantifiable predictions to gain a foothold in the competitive landscape.

Related reading

Next in line is the best altcoins of 2025 Housing loanwhich he calls “the official coin of Paddy Penguin, a major force in crypto.” Its remarkable community and cultural appeal reflect its $2.28 billion market value, and its omnipresent presence in ETF advertising, along with more than 90 billion views, seems to confirm its cult-like following.

The list of the best altcoins continues Clearpool (CPOOL)A $341 million decentralized capital market ecosystem that provides insured loans to institutional borrowers in the DeFi arena through a dynamic interest model. The analyst noted that Clearpool's approach to decentralized lending could be a unique avenue for strategic investors.

He also spotlights Bittensor (Tao)a $3.48 billion project aimed at decentralizing artificial intelligence solutions through an open ecosystem, and hyper liquid (HYPE)one Permanent decentralized exchange Living in your L1 with a market value of $9.23. He describes Hype's vision as “a high-speed, low-cost and transparent solution to perpetual futures trading,” though he advises caution, noting that potential investors should “do their research to understand the risks and potential.” “

At $397 million, Io.net is classified as a decentralized GPU network that lowers costs for AI developers. CFG (Center) It aims to bridge DeFi with real-world assets. The $162 million project is focused on sustainable returns from the real value of fiat, not just leveraging volatile cryptocurrencies.

Akash Network (AKT)Valued at $746 million, it is billed by Wacy as a supercloud that transforms cloud computing through a decentralized marketplace. Athena (ENA)with 2.69 billion dollars, one Artificial dollar protocol On Ethereum, it's advertised as a “bankless, cryptographic solution to money.”

Wacy's list was also highlighted helium (HNT) With a market cap of $1.13 billion, identified for the IoT decentralized network, and Grifain in the Solana ecosystem, with a market cap of $211 million, providing scalable DeFi solutions for token exchange while maintaining transparency.

Related reading

This analyst also emphasizes Grasso Listed as the best altcoins for 2025 and with a market cap of $683 million, the network describes its decentralized data collection for AI training as both practical and user-friendly. VitaDAO (LIFE) Wacy is in the spotlight because of the community's funding of the DAO's lifetime research. Its compact $54 million market cap appears poised for growth as members actively participate in decision-making and ownership, representing a collaborative approach to biotech research in crypto.

spectralWith a market cap of $194 million, it offers chain agents for easier application creation and includes a syntax tool that converts natural language into Solidity. ETIGENOr the $170 million Energy Layer expands new renewable energy concepts on Ethereum and ONDOwith a significant market capitalization of $2.83 billion, aims to unlock enterprise-class DeFi services and real-world asset (RWA) tokenization.

Wacy separates more from it AIXTBvalued at $377 million, which monitors crypto-related discussions through a proprietary engine to discover high-sentiment opportunities, and Ether.fi (ETHFI)priced at $446 million, which supports ETH subscriptions and DeFi integration. During his tenure, he emphasized the cyclical nature of the crypto market, stating that these top altcoins “could grow significantly in 2025” when capital flows away from Bitcoin and into high-potential altcoin narratives.

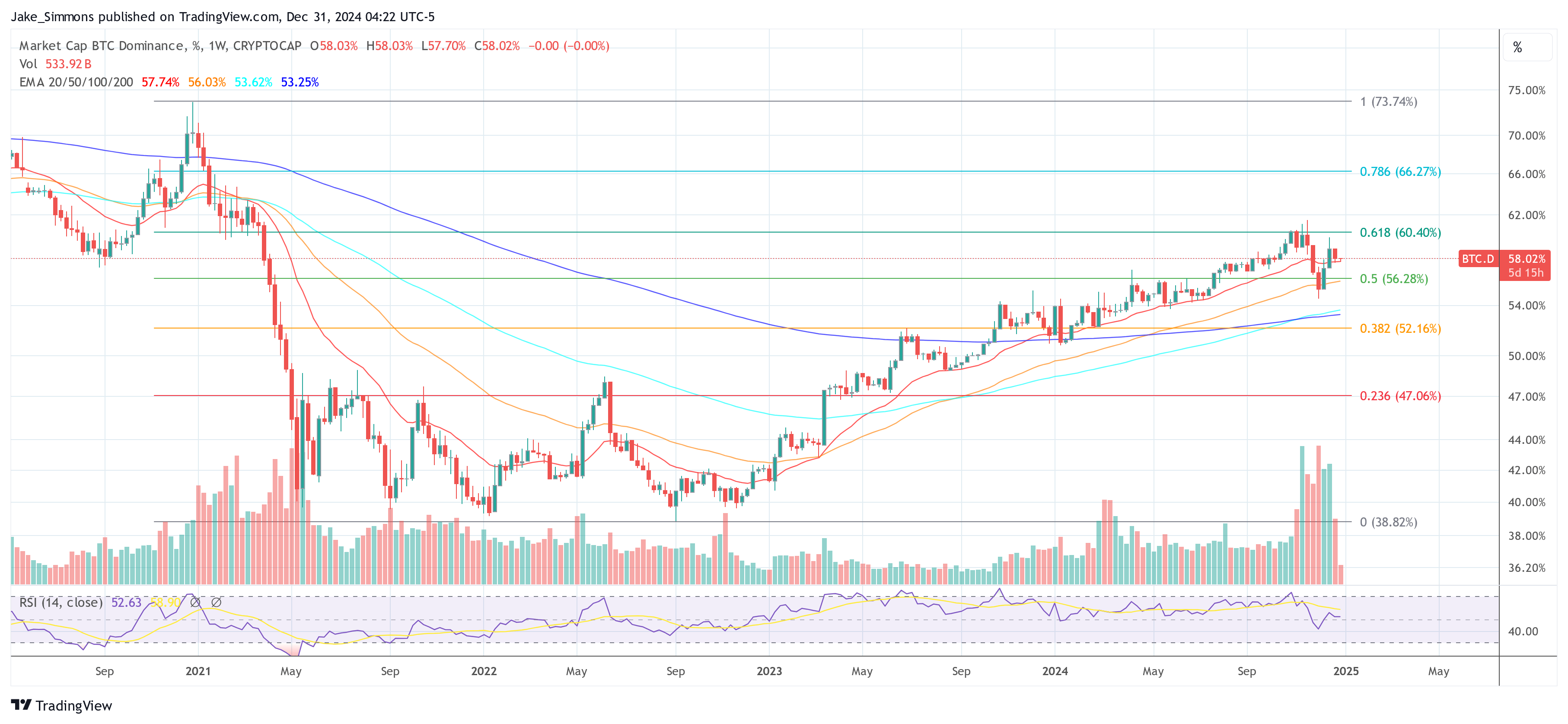

His overall thesis hinges on what he perceives as a predictable pattern in every major market cycle. “Altcoins are usually pumped when Bitcoin dominance starts a strong downtrend,” the analyst wrote. He cited the example of 2021, when Bitcoin's dominance dropped from around 73% to 40%, giving rise to altcoins like SOL, ADA and DOGE.

Noting that BTC's current dominance is around 55%, which he calls a “significant resistance zone,” he predicts a rapid drop to 40% if a breakout occurs. “As I mentioned before, my bet is for a second season in the spring of 2025,” he said. “That's okay, it means the market is doing a good job of 'smoking people'. Patience my friends, patience always pays off.”

At press time, Bitcoin (BTC.D) dominance reached 58.02%.

Featured image created with DALL.E, chart from TradingView.com