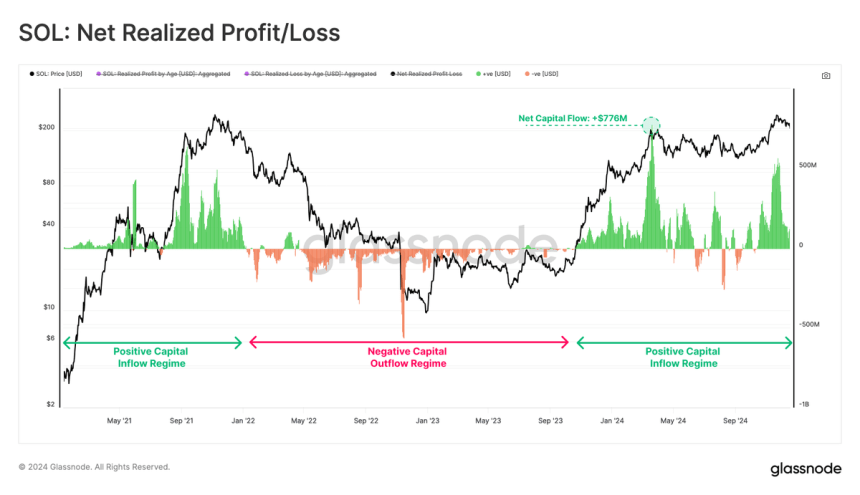

Solana has made a significant recovery, rising more than 14% from its recent local lows, showing resilience after a period of correction. This resurgence has reignited investor optimism and established Solana as a standout in the crypto market. Glassnode's key metrics further reinforce these sentiments, showing that Solana has consistently maintained a positive net capital flow since early September 2023. While minor outflows were observed, the overall trend indicates sustained interest and confidence in the project.

Related reading

These capital flows highlight the growing adoption and use of Solana and show that the blockchain ecosystem continues to attract new contributors and capital. As the market continues to evolve, such metrics indicate that Solana is poised for continued growth, supported by a strong foundation and thriving developer community.

Due to its recovery, Solana remains a top contender For investors who are looking at projects with strong long-term potential. The continued flow of capital not only reflects market confidence, but also paves the way for further expansion in the coming months. Whether through innovative dApps, advanced scalability, or increased network activity, Solana's upward trajectory appears far from over, making it a focal point in the broader cryptocurrency landscape.

Solana's metrics show a growing network

Solana appears poised for a massive rally next year as its network continues to demonstrate sustainable growth and resilience. Solana has consistently recorded positive net inflows since early September 2023, according to Glassnode Insights.

One of the most obvious revelations of this report is the daily peak of $776 million in new capital, which shows significant interest and participation in the ecosystem. This constant influx of liquidity has not only fueled Solana's growth, but has also played a key role in supporting price stability and growth. Such a steady flow of capital shows that investors see Solana as a high-potential project that could outperform in the coming months.

Related reading

With strong fundamentals, growing adoption and increasing developer activity, Solana's upward trajectory is well positioned to continue. If the current trend of capital flows continues, it could act as a catalyst for a massive rally, potentially surpassing previous highs.

As we look to 2025, Solana remains a project to watch, giving investors an opportunity to participate in a blockchain ecosystem that is rapidly gaining popularity in the crypto space.

Strong jump from key demand

Solana (SOL) is currently trading at $199 after successfully bouncing off the $175 level, a critical demand area that has proven to be a strong support zone. This return demonstrates Solana's underlying strength and its ability to attract buyers at key levels, setting the stage for further upside. $175 has historically served as a launching pad for SOL and this time is no different as the price is now targeting higher levels.

If Solana can break above the $210 resistance level in the coming days, a quick rally is likely to follow. A break of this barrier could signal a strong upside move, potentially pushing SOL to new highs and reigniting investor enthusiasm. However, the market can also experience a period of lateral consolidation as traders assess current conditions and prepare for the next major move.

Related reading

Consolidation above the $190 level remains a positive sign, indicating that SOL is building a solid base for its next rally. Holding strength around these levels is critical to maintaining a bullish outlook, as any failure to hold could result in a retest of lower demand areas. Currently, all eyes are on Solana as it moves through key price levels and prepares for its next move.

Featured image from Dall-E, chart from TradingView