Japan-based early-stage investment firm Metaplanet continues to buy Bitcoin (BTC). company announced Today, it bought 619.7 bitcoins for $61 million — including fees and other expenses — making it the company's largest bitcoin purchase to date.

Metaplanet increased BTC holdings to 1,762

The recent slump in the crypto market from its all-time high (ATH) didn't seem to bother MetaPlanet, as the Tokyo-listed company made its biggest BTC purchase to date, selling 619.7 BTC worth $61 million at the average price. It has bought about 96,000 dollars.

Related reading

As a reminder, MetaPlant started buying Bitcoin earlier this year in May by buying 97.9 Bitcoin. Since then, the company has bought bitcoins every month, with the exception of September and passed 1000 BTC milestone in November. The latest purchase brings MetaPlant's total bitcoin holdings to 1,762, purchased at an average price of $75,600 per bitcoin.

Notably, this $61 million purchase is nearly double the value of MetaPlant's previous purchase, which took place in November and was valued at nearly $30 million. The firm's steady accumulation of Bitcoin has earned it the nickname “MicroStrategy Asia,” a reference to the US-based business intelligence firm known for its aggressive Bitcoin buying strategy.

It's worth noting that today's BTC purchase comes a week after Metaplanet raised $60.6 million through two tranches of bond issuance to “accelerate BTC purchases.” Metaplanet's latest acquisition also makes its BTC the 12th largest publicly traded company worldwide.

According to MetaPlant's official announcement, its Bitcoin return – a proprietary metric used to measure the performance of its Bitcoin buying strategy – reached 310% from October 1st to December 23rd. The company stressed that the strategy was designed to be “passive for shareholders. “

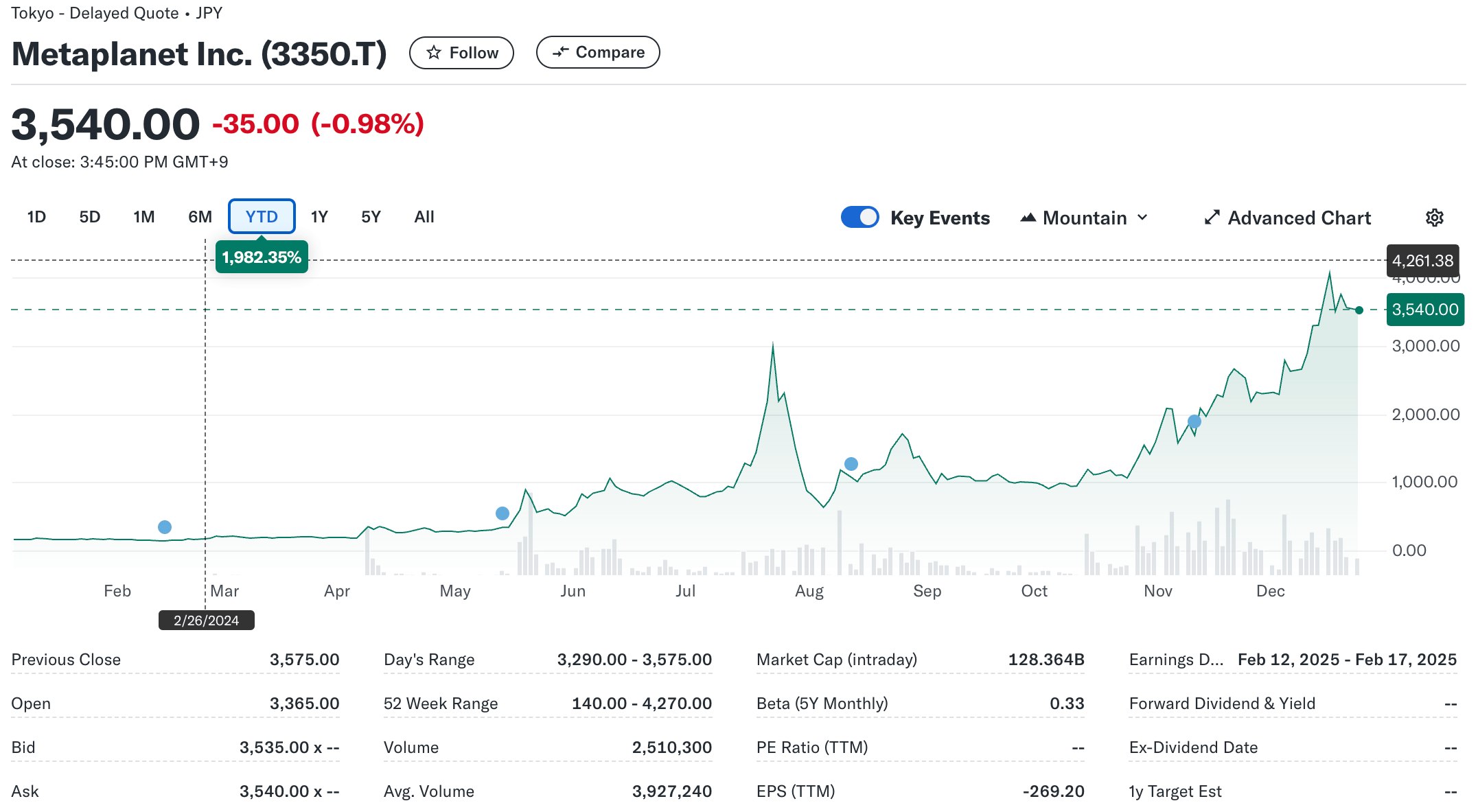

Despite today's significant BTC buying, Metaplanet's share price saw little movement and closed at $22.5, down 0.98% on the day. However, on a year-to-date basis, the company's stock is up a staggering 1,982%, reflecting the long-term benefits of its Bitcoin-centric strategy.

Reducing Bitcoin Supply to Accelerate Adoption?

With Bitcoin's maximum supply capped at 21 million, the digital asset has cemented its reputation as an inflation-resistant store of value. recent report It shows that the supply of Bitcoin on crypto exchanges has reached its lowest level in several years, indicating that holders are increasingly withdrawing Bitcoin from exchanges, reducing the circulating supply and potentially pushing prices higher.

Related reading

The scarcity of Bitcoin has created an unofficial race among companies – and possibly even governments. For example, recently the Bitcoin mining company Hut 8 has been purchased 990 BTC for $100 million, increasing its total holdings to over 10,000 BTC. Similarly, MARA, another Bitcoin mining company, earned 703 bitcoins earlier this month, bringing its total holdings to 34,794 bitcoins.

Speculation abounds over the US strategic bitcoin reserve strengthen Narrative of the BTC supply crisis, which may quickly follow its adoption. At press time, BTC is trading at $94,003, down 1.5% in the last 24 hours.

Featured image from Unsplash, charts from Yahoo! Finance and Tradingview.com