As 2024 draws to a close, Ethereum price volatility will be closely watched. As a recent analysis by cryptocurrency experts shows, the trajectory of the digital currency is heavily influenced by key resistance and support levels, indicating a cautiously optimistic outlook.

Related reading

Important price levels to monitor

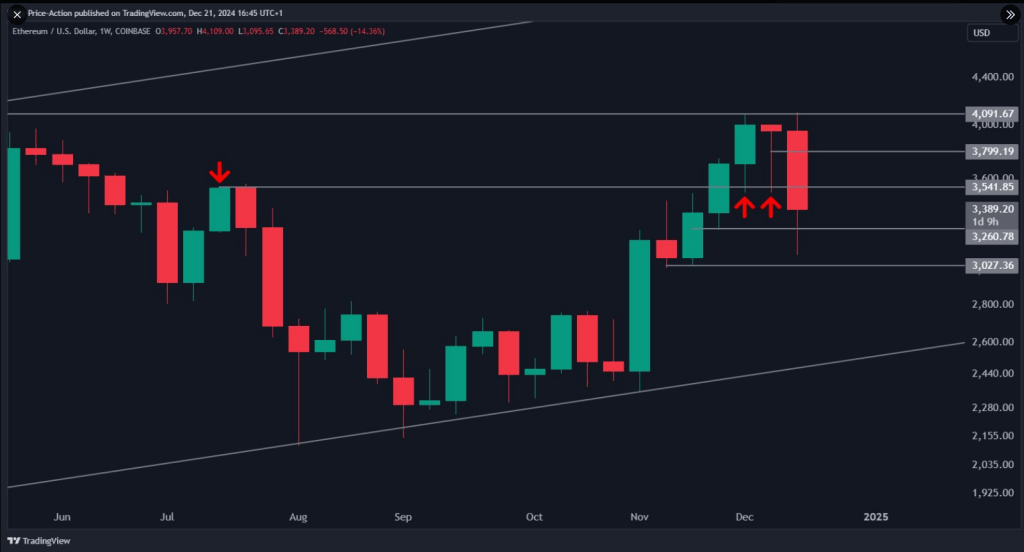

In cryptocurrency analysis, Justin Bennett emphasized the importance of Ethereum retrieving the $3,540 weekly level on December 22.

If Ethereum fails to clear this barrier, it risks falling below the significant $3,000 support zone, leading to a drop to $2,600. For investors as well as speculators, this reduction will be costly.

As I'm bullish with the overall launch in 2025, buyers still have work to do.

For example, $ETH It needs to recover $3,540 on the weekly time frame to look bullish next week.

Buyers have 33 hours to do so.# Ethereum pic.twitter.com/cAChCbJxjd

— Justin Bennett (@JustinBennettFX) December 21, 2024

Market sentiment and analysts' forecasts

Titan of Crypto's analysis, which used the Ichimoku cloud approach to predict a potential recovery, further bolsters the optimism surrounding Ethereum.

The analyst noted that Ethereum has retested some critical levels, which gives the impression that the current correction cycle is underway. It is nearing its end. The strength of Kumo Cloud's support line suggests that if Ethereum can hold current levels, it may be a base for higher moves.

Whales increase aggregation

Meanwhile, Ethereum whales have increased their holdings and in just a few days have collected around 340,000 ETH worth over $1 billion. This increase in accumulation indicates that large investors are becoming more confident about the altcoin's prospects.

Ethereum Whales Bought $1 Billion ETH in Last 96 Hours – Details https://t.co/fZe8jWmQ3S

— Jose JM (@CryptoJoseJM) December 22, 2024

Additionally, spot Ethereum ETFs have seen more than $2 billion in flows since their introduction to the US market, reflecting the growing interest in these instruments. If regulators allow returns to be invested in these funds, analysts predict the trend could overtake bitcoin ETFs by 2025.

Ethereum price prediction

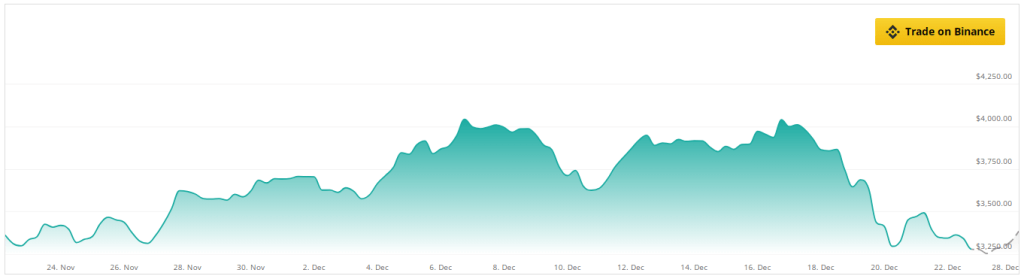

At the time of writing, it was ether It is trading at $3330Data from Coingecko shows that it was down 0.7% and 15.7% on daily and weekly time frames.

Based on how the Ethereum market is doing right now, even though Ether numbers are flashing red on the charts, there is likely to be a positive uptrend over the next week.

Analysts are optimistic about its chances of recovery, even if it sells at a 21 percent discount to its value in a month.

Source: CoinCheckup

A potential breakout that could test critical resistance levels is indicated by technical indicators such as the Relative Strength Index (RSI) and moving averages.

Ethereum is expected to experience a strong development path in the medium to long term, with a 35% price increase in the next three months and a significant 100% growth within a year. Predictions

Featured image from DALL-E, chart from TradingView