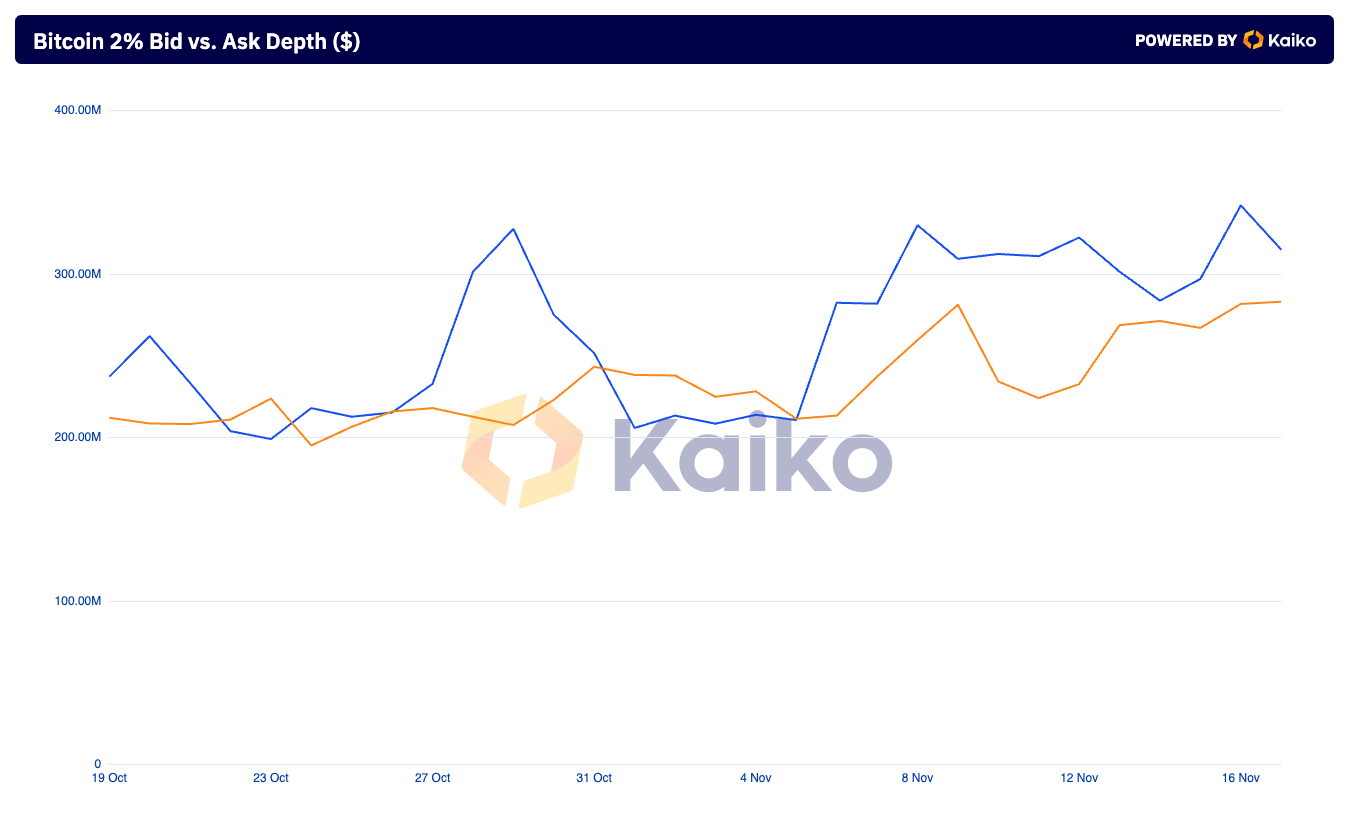

Bitcoin Total 2% market depth, a measure of liquidity that combines buy and sell orders within a narrow 2% range around the market price, hit a one-year high of $623.40 million as of Nov. 16. This represents a significant increase. From $422 million on November 5 – a significant increase in liquidity in a short period.

This indicates an increase in market confidence, as deeper liquidity typically indicates that traders and institutions are more willing to participate in the market, creating a buffer against price volatility.

This increase in market depth leading up to and following the US presidential election is not an isolated event, but part of a broader shift in macroeconomic and political conditions. The election of Donald Trump and his administration's stated intention to support Bitcoin and the crypto industry through specific policies has fueled market activity.

This new political alignment with the crypto space is likely to send a message to retail and institutional investors that the regulatory environment could become significantly more favorable, reducing perceived risks and encouraging greater participation.

The market responded enthusiastically to the prospect of a pro-crypto government, and traders are likely to interpret the news as a green light for wider adoption and institutional flows. This increase in price, along with an increase in overall market depth, indicates that market participants are trading in response to the election results and positioning for a sustained uptrend. The expanded market depth reflects this increased interaction, as deeper liquidity allows larger orders to be executed with minimal slippage – which is critical in a market experiencing rapid upward price swings.

The impact of the election can be seen in the depth of the offer versus the request. While the imbalance in favor of sell orders of $341.81 million versus $281.59 million in buy orders suggests profit-taking, it is important to note that this activity did not cause a significant price correction. Instead, the market effectively absorbed selling pressure, indicating strong buyer demand even as Bitcoin broke through $93,000.

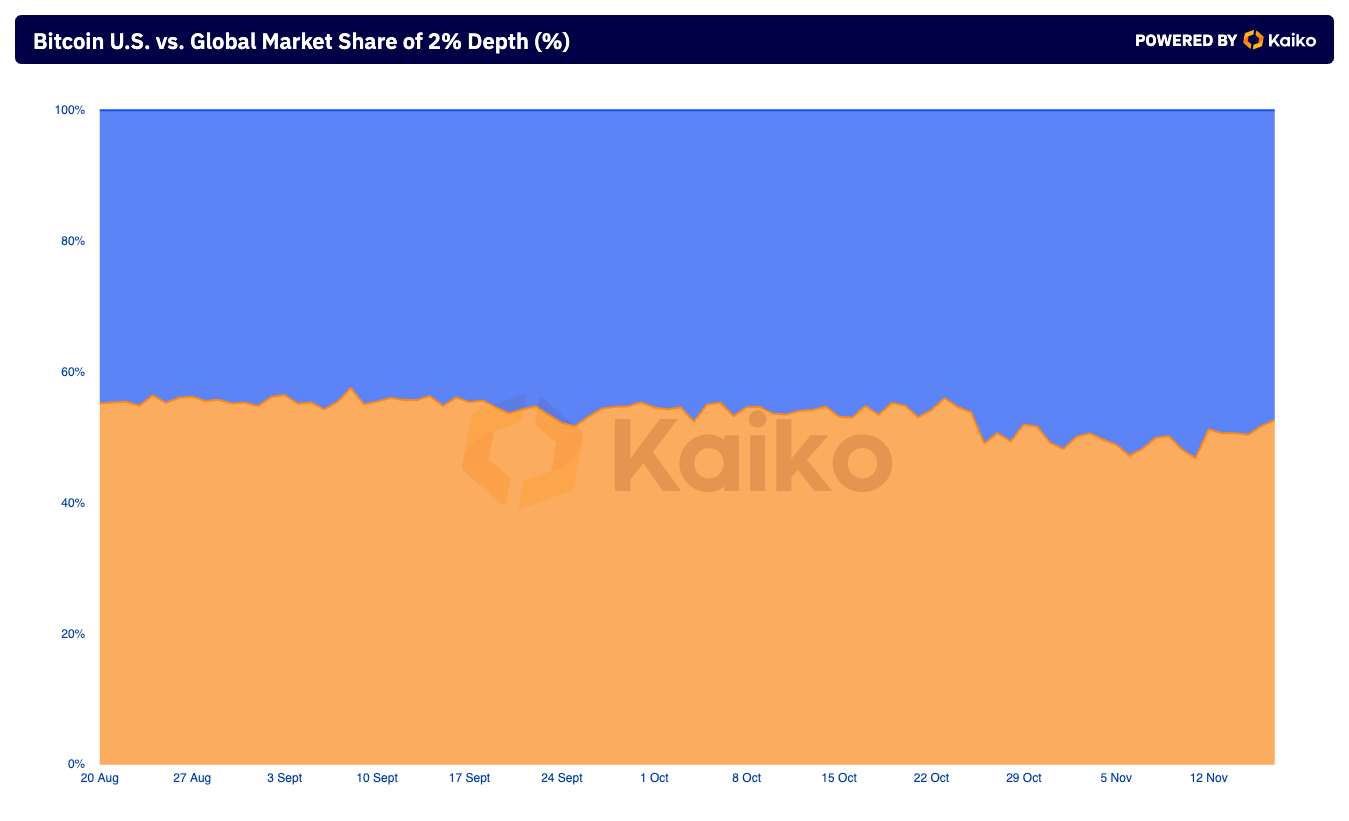

The historically dominant US market share of global market depth appears to have played a significant role in driving this increase in liquidity. Although US market share fell slightly after the election, the broader trend in 2024 – where the US accounted for more than 50% of the global market share – suggests that US institutions and traders are shaping activity. The market has played an essential role.

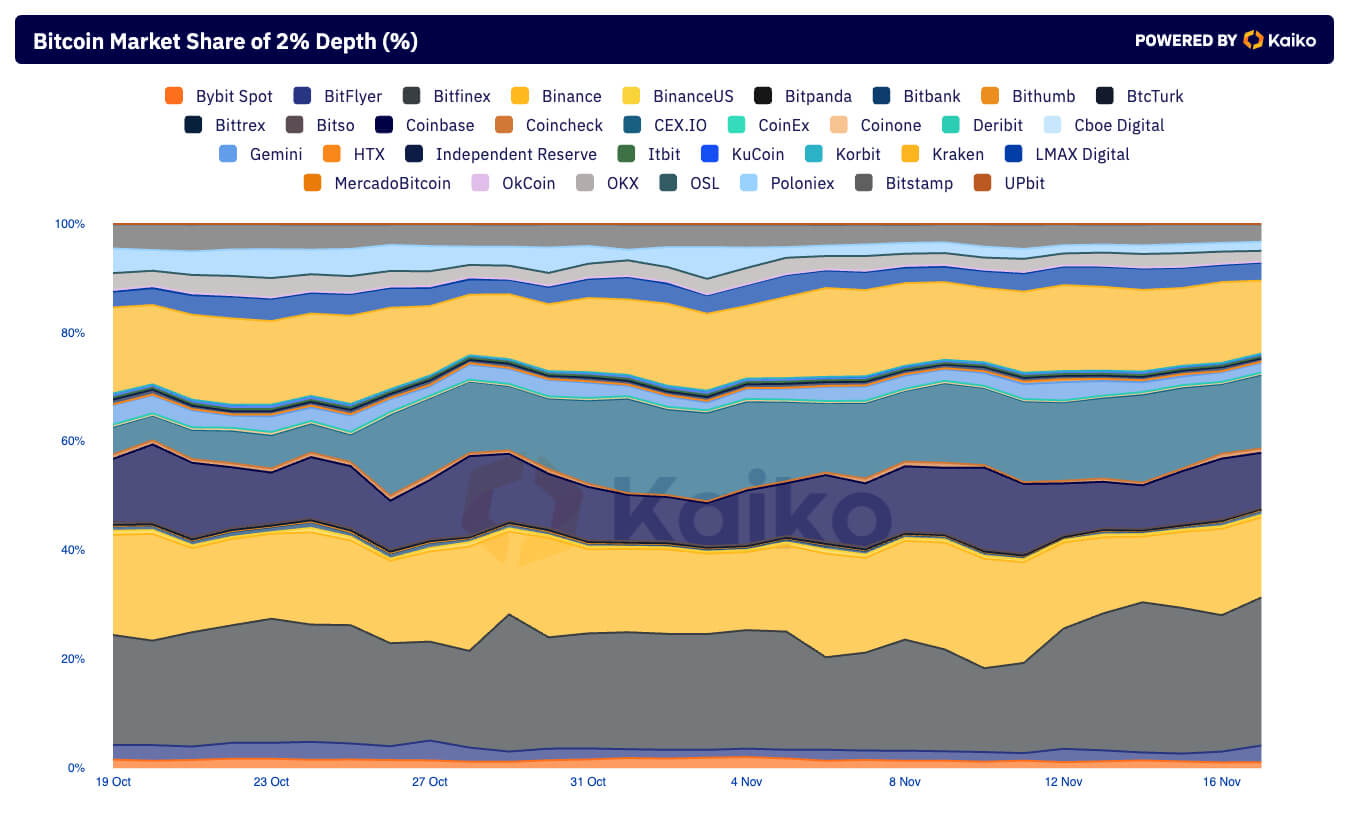

At the exchange-specific level, Bitfinex's emergence as a leader in global market depth may indicate its ability to attract liquidity amid these political and market changes. The exchange's 27 percent share on Nov. 16 coincided with Bitcoin's post-election rally, indicating that BitFinx has successfully captured a significant portion of the surge in trading activity.

In contrast, Binance's decline, which fluctuated between 10 and 15 percent in November, can be attributed to ongoing regulatory scrutiny, which may have deterred institutional players from using its platform despite broader market optimism. be

post The US election pushed Bitcoin liquidity to an all-time high appeared first CryptoSlate.